New Venmo taxation rules have been implemented, and it’s important to understand how they will affect you. With the Internal Revenue Service pushing back its $600 reporting regulation for payment transactions involving goods and services by one year, now is your chance to gain knowledge about what this could mean for your business. In this blog post, we’ll discuss what these new rules are, how they could potentially affect your finances, and what you can do to ensure that you’re filing correctly.

Does Venmo Report to the IRS?

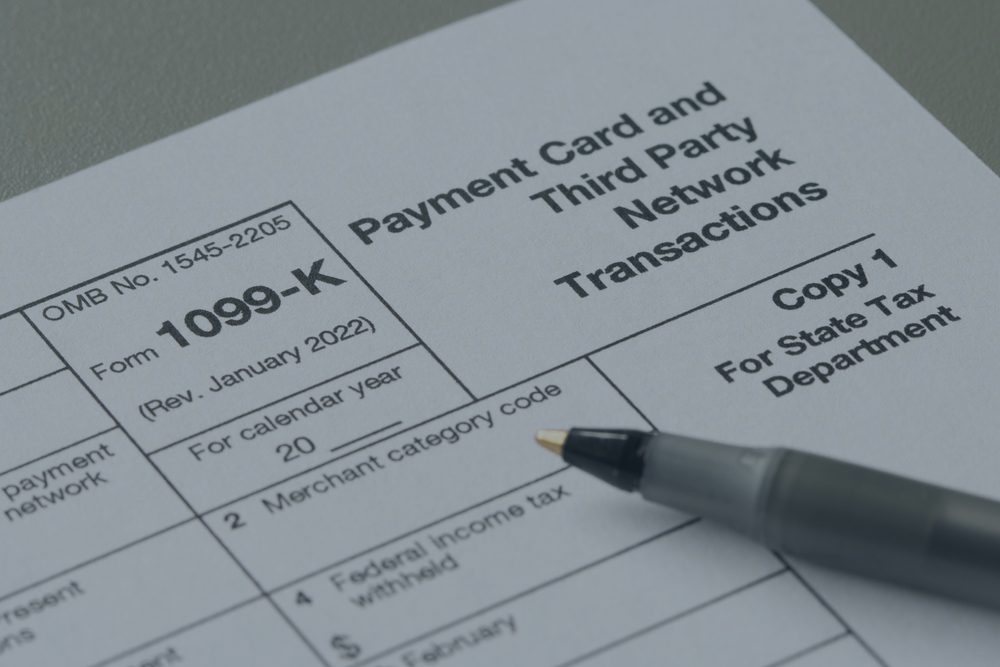

In the past, Venmo did not report to the IRS. This was because it was primarily used for person-to-person (P2P) payments and transactions between friends and family. However, in 2016, Venmo began allowing businesses to accept payments through their platform, which changed the tax implications of using P2P apps. As a result, the IRS has implemented new rules that require third-party payment processors like Venmo to report income made over $600 to the IRS, starting in 2023. For 2022 tax-year transactions, the previous threshold of over $20,000 or more than 200 transactions will still be enforced.

This means that if you are collecting regular payments from clients via third-party apps like Venmo, you will need to take extra steps to ensure compliance.

New Rules Regarding Venmo Taxes

The new taxation rules that Venmo is subject to require you to set yourself up for proper tax reporting. If you are collecting regular payments from customers through this platform, you will need to track your income and report it on your taxes accordingly.

Venmo does not automatically dock any money for taxes. You need to keep track of the income you receive and set aside money for taxes. Additionally, if you are filing as self-employed or a small business owner, you must make estimated payments quarterly to avoid potential penalties.

It’s also important to note that Venmo reserves the right to collect information from users regarding their service use and may report that information to the IRS. If you are not reporting income from these payments, keeping accurate records of your transactions for your own accounting purposes is important.

Navigate Changing Tax Legislation

The new Venmo taxation rules can be a bit daunting at first, but understanding how they work is key to ensuring compliance and avoiding any potential penalties. Whether you’re a business owner or an individual who uses Venmo regularly, it’s important to stay up to date on how these changes could affect your taxes and finances.

At Raines & Fischer, we understand the importance of tax compliance for small business owners and individuals who use payment processing platforms such as Venmo and PayPal. Our experienced professionals provide year-round guidance so that our clients can see the bigger financial picture. We work closely with fund managers, business owners, and individuals to ensure that their finances are in order and that they are compliant with all applicable tax laws. With our step-by-step approach, our clients can rest assured that their taxes are taken care of properly. Get in touch with us today to learn more about how we can help you navigate Venmo taxation rules.